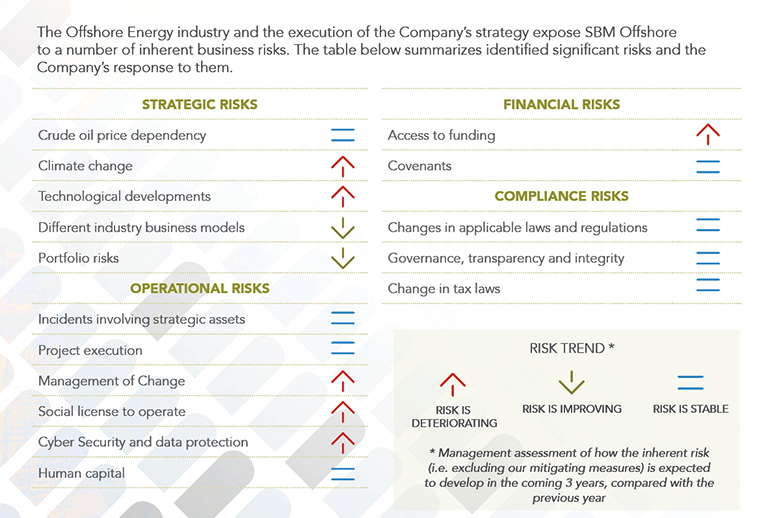

3.7.3Significant Risks to the Business

|

RISK |

DEFINITION |

RESPONSE MEASURES |

|---|---|---|

|

Strategic Risks |

||

|

Crude oil price dependency |

Whilst the oil price has begun to stabilize since 2017 onwards and signals in the industry are positive, dependency on the oil price remains an inherent Company risk. The Company continues to be mindful of this dependency over the long-term, where a negative development with delays or cancellations of planned investments could lead to a severe effect on SBM Offshore’s new order intake. |

Our focus towards cost optimization and de-risking remains a priority for the Company. Whilst diversifying our product portfolio we maintain offering highly competitive solutions to our clients. To drive better performance faster, the Company is undertaking multiple initiatives in relation to digitalization and standardization, which are the basis for the Company’s Fast4Ward® principle-based approach. For further details, see section 2.2 Fast4Ward® |

|

Climate change |

SBM Offshore could face the impact of an accelerated energy transition driven by, amongst other things, climate change. The Company may lose its competitiveness if it does not succeed in (i) development of concrete and competitive technologies to enhance its product portfolio and (ii) enhance the energy efficiency of its existing offerings. |

SBM Offshore regularly updates its strategy in light of the evolution of the energy landscape. It is diversifying its product portfolio through investments in new technology and products for Gas & Renewables markets. In addition, SBM Offshore is reducing the emissions of our existing units and has the ambition to design zero-emissions products for the future. For further details, see section 2.1 Group Strategy |

|

Technological developments |

SBM Offshore is committed to pioneering new technologies, including digitalization, and maintaining a high level of technical expertise. Main risks include the possibility of employing immature new technologies and the risk of implementing proven technologies incorrectly, causing potential damage to Company’s business results and reputation. |

SBM Offshore employs a rigorous TRL assessment of new technologies, which are verified and controlled at several stages of their development phase by senior technical experts, before being adopted within projects. Furthermore, a strong technical assurance function ensures compliance with internal and external technical standards, regulations and guidelines. For further details, see section 2.9 Technology |

|

Different industry business models |

Clients are exploring different business models that could influence the long-term validity of the operations business model, as pursued by the Company today. This presents opportunities (different pricing models), as well as risks. |

SBM Offshore is pro-actively engaging with its clients to develop value propositions for the traditional, as well as newer, business models and carefully monitors market trends. For further details, see section 1.6 Position within the Value Chain |

|

Portfolio risks |

The Company’s backlog has a limited geographical distribution. There is a particular concentration of business activities in Brazil and, to a much lesser extent, Angola and Guyana. SBM Offshore thus has portfolio risks that may increase the impact of changes in local legislative and business environments, potentially affecting the Company’s business results. The Company also recognizes its dependence on a limited number of current and potential clients, as well as project execution challenges in new markets. |

SBM Offshore aims to reach a more balanced regional portfolio, achievable by diversifying into new markets, such as in Guyana, and different products, such as in Renewables and Gas. The Company conducts thorough risk assessments for new country entries. The Company actively engages with its clients to monitor and mitigate the respective country-related regulatory, commercial and technical risks. For further details, see section 1.2 SBM Offshore and its Global Presence |

|

Operational Risks |

||

|

Risks related to incidents involving strategic assets |

SBM Offshore operates a large fleet of FPSOs worldwide for many clients. Given the long duration of Lease and Operate contracts, several factors, such as HSSE incidents or accidents, may have immediate and/or long-term negative effects on the people affected and the operation of the assets and their capability to perform according to the design criteria. |

The Company devotes considerable resources to ensure the fleet is performing safely and to high quality standards. Control and maintenance of all equipment are vital to daily activities on board, particularly for safety critical elements. Fleet performance is continuously monitored and feedback to the technology team helps to mitigate risk and ensure inherent safety at the design stage. Ongoing advances are incorporated into upgrades onboard, further enhancing safety. Specialist teams are in place in the event of any process safety incidents. For further details, see section 2.6 Health, Safety, Security and Environment |

|

Project execution |

Inherent project execution risks exist due to a combination of geopolitical country(s) risk, challenging/immature regulatory environment, technical risks (such as those related to technical specifications and harsh environments), asset integrity risks and third-party management risks, leading to potential negative impact on people, reputation, cost, schedule and environment. |

Managing project execution risk is part of SBM Offshore’s DNA and embedded in SBM Offshore’s core business processes and ways of working. Proper business case analysis, country (entry) risk assessments, suitable project management capabilities and capacities, combined with SBM Offshore’s professional ways of working, processes and procedures mitigate project execution risk. Additional risk mitigating measures are in place related to knowledge and understanding of the countries of project execution and delivery. Technology and Business Readiness Level (TRL/BRL) mitigate specific technical development-related execution risks. For further details, see section 2.7 Operational Excellence |

|

Management of Change |

SBM Offshore pursues benefit realization of our Fast4Ward model and Digital Transformation program. Failure to achieve its anticipated benefits could damage our competitiveness, reputation and credibility towards our stakeholders. The ability to optimize our business follows a parallel journey, with the capability to embrace new ways of working and incorporating lessons learned along the way. |

The Fast4Ward and Digital Transformation programs are of utmost importance to SBM Offshore. Management of Change is identified as a key success factor of these programs. Senior management is fully committed to making them a success. This materializes in sufficient investments, continuous attention and communication to all employees. Change Management ambassadors are appointed and working closely with the business in our journey towards the new ways of working . For further details, see section 2.2 Fast4Ward® |

|

Social License to Operate |

Pressure on the oil and gas industry could harm our reputation. This could damage our brand, impact our social license to operate and limit our ability to finance our projects and recruit staff. Other factors, including the effects of other risks mentioned or impacts as a result of Human Rights, could negatively impact our reputation and could have a material adverse effect as well. |

It is SBM Offshore Vision that the oceans will provide the world with safe, sustainable and affordable energy for generations to come. As a result thereof, we have an strategy which is aimed at this vision. During our engagements with stakeholders, we aim for a joint roadmap in line with our vision. This is substantiated by pursuit of credible, ambitious sustainability initiatives and disciplined governance thereof. For further details, see section 2.3 Sustainability |

|

Cyber Security and data protection |

To carry out its activities, SBM Offshore relies on information and data, much of which is confidential or proprietary, that is stored and processed in electronic format. Potential intrusion into the Company’s data systems hosted on servers and offshore equipment may affect onshore and offshore activities. Secondary risks include theft of cash, proprietary and/or confidential information, with potential loss of competitiveness and business interruption. |

Given the evolving nature of cyber security threats, this topic requires continuous focus. There is a dedicated ongoing improvement campaign, sponsored by a senior steering committee, to reduce the risk profile through investments in hardware, software and training. The ability of the IT architecture and associated processes and controls to withstand cyber-attacks and meet recognized standards is periodically subject to independent testing and audits. |

|

Human capital |

The Company aims to source and maintain the human resources in terms of capacity, as well as capability, to support its anticipated increased project activity levels, as well as the ongoing operational fleet. Failure to attract and retain the right level of competences could ultimately have an adverse impact on the Company’s operations and contractual relationships with clients. |

The Company’s recruitment activities have significantly increased in 2019. Furthermore, a talent-development program is in place to specifically engage and retain key personnel. The Company fosters a culture of ownership at all levels of the organization. For further details, see section 2.8 Our People: Our Competitive Edge |

|

Financial Risks |

||

|

Access to funding |

Access to multiple sources of debt and equity funding is essential to facilitate the growth of SBM Offshore’s FPSO fleet and other Product Lines. Failure to obtain such funding could hamper growth for the Company and ultimately prevent it from taking on new projects that could adversely affect the Company’s business results and financial condition. |

The Company maintains an adequate capital structure and cash at hand. The Company has access to a Revolving Credit Facility (RCF) and both cash at hand and the RCF can be used to finance investments in projects. From a long-term perspective, adequate access to debt and equity funding can be secured through use of |

|

Covenants |

Financial covenants need to be met with the Company’s RCF lenders. Failure to maintain financial covenants may adversely affect the Company’s ability to finance its ongoing activities. |

The RCF contains a set of financial covenants. The Company aims to have sufficient headroom in relation to the financial ratios. The covenants are monitored continuously, with a short-term and a long-term horizon. |

|

Compliance Risks |

||

|

Changes in applicable Laws and Regulations |

Changes in, and to, regulatory frameworks, including changes in enforcement strategies by local regulators if not properly identified and implemented may expose the Company to fines, sanctions or penalties. Moreover, changes to the applicable ‘local content’ requirements may expose the Company to additional costs or delays and affect the proposed execution methods for projects. |

SBM Offshore intends to carry out its activities in compliance with laws and regulations valid in the relevant territory, including international protocols or conventions, which apply to the specific segment of operation. Continuous monitoring of applicable laws and regulations is constantly carried out by relevant functions within SBM Offshore and substantive changes are brought to the attention of Management. Furthermore, downside risk of changes in laws and regulations is mitigated as much as possible within our contracts. |

|

Governance, transparency and integrity |

Fraud, bribery or corruption could severely harm the Company’s reputation, finances and business results. It is of utmost importance that such events shall be prevented. Previous failures to live up to the values have led to financial penalties being imposed on the Company in the past by authoirities in the Netherlands, the USA and Brazil. |

The Company’s Compliance Program provides policy, training, guidance and risk-based oversight and control on compliance risk, that [seek to] ensure ethical decision-making. Implementation of digital tools supports the continuous development of the Company’s Compliance Program. The Company’s Core Values and Code of Conduct guide employees and business partners on compliant behaviors in line with the Company’s principles. For further details, see section 3.8 Compliance. |

|

Change in tax laws |

Tax Regulations applicable in jurisdictions of operation may change, resulting in an increase in the effective tax burden, which could adversely affect the Company’s business, results and financial condition. Additionally, public perception of the ways that corporations manage their tax affairs continues to evolve with potential adverse impacts on the Company‘s reputation. |

With the exception of some short-term contracts, all contracts entered into by the Company include some provisions to protect the Company against an increase in tax burden resulting from changes in tax regulations, or the interpretation thereof. The Company aims at achieving a stable tax burden over the life of contracts and cooperates closely with clients’ tax teams to this end. SBM Offshore values public perception, good relationships with tax authorities and is committed to act as a good corporate citizen, to ensure that Company‘s tax policy is in line with the expectations of society. For further details, see section 3.9 Company Tax Policy |