3.6Shareholder Information

Listing

SBM Offshore has been listed on Euronext Amsterdam since 1965. The market capitalization as at year-end 2019 was US$3.7 billion. The majority of the Company’s shareholders are institutional long-term investors.

Financial Disclosures

SBM Offshore publishes audited full-year earnings results and unaudited half-year earnings results, which include financials, within sixty days after the close of the reporting period. For the first and third quarters, SBM Offshore publishes a trading update, which includes important Company news and financial highlights. The Company conducts a conference call and webcast for all earnings releases and a conference call only for all trading updates during which the Management team presents the results and answers questions. All earnings-related information, including press releases, presentations and conference call details are available on the SBM Offshore website. Please see the Financial Calendar of 2020 at the end of this section for details of the timing of publication of financial disclosures for the remainder of 2020.

In 2018, the Company expanded its ‘Directional’ reporting. In addition to the Directional income statement, reported since 2013, a Directional balance sheet and cash flow statement are also disclosed in section 4.3.2 of the Consolidated Financial Statements. Expanding Directional reporting aims to increase transparency in relation to SBM Offshore’s cash flow generating capacity and to facilitate investor and analyst review and financial modeling. Furthermore, it also reflects how Management monitors and assesses financial performance of the Company. Directional reporting is included in the audited Consolidated Financial Statements in section 4.3.2.

Dividend Policy & Capital allocation

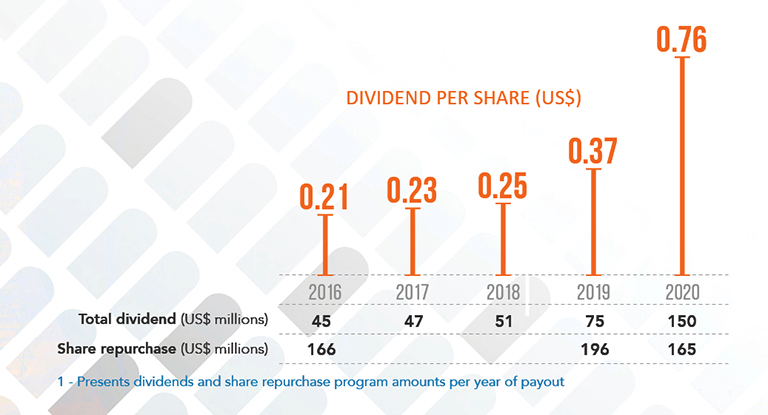

The Company’s policy is to maintain a stable dividend, which grows over time. Determination of the dividend is based on the Company’s assessment of its underlying cash flow position.

Regarding capital allocation, the Company prioritizes payment of the dividend, followed by the financing of growth, with the option thereafter to repurchase shares, depending on residual financial capacity and cash flow outlook.

Shareholder returns1

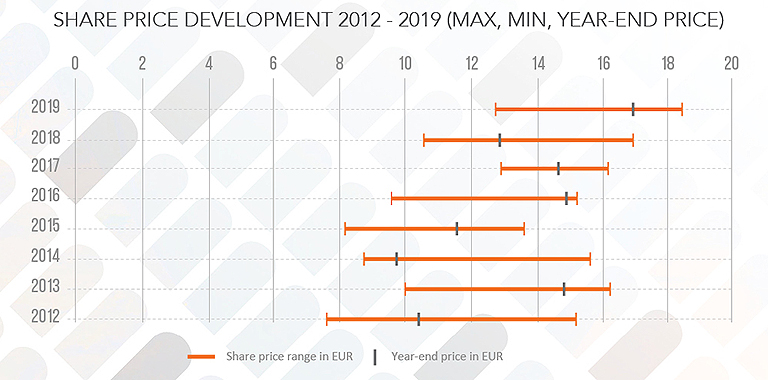

Share price development

Share price development in 2019

|

Year-end price |

EUR 16.59 |

December 31, 2019 |

|

Highest closing price |

EUR 18.35 |

July 16, 2019 |

|

Lowest closing price |

EUR 12.80 |

January 2, 2019 |

|

For 2019 the press releases covering the key news items are listed below: |

|

|

|

|---|---|

|

14-02-19 |

2018 Full-Year Earnings |

|

14-02-19 |

Announcement Share Repurchase |

|

14-02-19 |

Proposal Re-Appointments Management Board and Supervisory Board |

|

27-02-19 |

Annual General Meeting of Shareholders Announcement |

|

29-03-19 |

Challenge of AFM fine related to timing of disclosures between 2012 and 2014 |

|

10-04-19 |

Annual General Meeting of Shareholders − 2019 Resolutions |

|

10-05-19 |

Awarded Contracts for ExxonMobil FPSO Liza Unity |

|

16-05-19 |

2019 First Quarter Trading Update |

|

20-05-19 |

Completion 2019 Share Repurchase Program |

|

11-06-19 |

Awarded Letter of Intent for FPSO Mero 2 Lease and Operate Contracts by Petrobras |

|

08-08-19 |

2019 Half-Year Earnings |

|

06-09-19 |

Signing of Long-Term FPSO supply agreement with ExxonMobil |

|

30-09-19 |

Confirming Participation in Auction for Partner's Minority Ownership in SBM Offshore Operated Companies |

|

09-10-19 |

Confirming Formal Closure of Brazil Legacy Case |

|

16-10-19 |

Completion US$1.14 billion Financing of Liza Unity |

|

18-10-19 |

Successful Bidder for Partner's Minority Ownership in SBM Offshore Operated FPSO Companies |

|

07-11-19 |

Awarded Contracts for Exxonmobil's Third FPSO in Guyana Based on its Fast4Ward® Program |

|

14-11-19 |

2019 Third Quarter Trading Update |

|

22-11-19 |

Completion Transaction Regarding Minority Ownership in SBM Offshore operated FPSO Companies |

|

05-12-19 |

Ordering Two Additional Fast4Ward® Hulls, Bringing the Construction Program to a Total of Five Hulls |

|

09-12-19 |

Optimizing FPSO N'Goma Project Loan |

|

11-12-19 |

Floris Deckers to Retire as Chairman of the Supervisory Board |

|

11-12-19 |

Signing FPSO Sepetiba Contracts |

|

13-12-19 |

Divesting Minority Interesy in FPSO Sepetiba Projects |

|

23-12-19 |

FPSO Liza Destiny Producing and on Hire |

Major SHAREHOLDERS

As at December 31, 2019, the following investors holding ordinary shares had notified an interest of 3% or more of the Company’s issued share capital to the Autoriteit Financiële Markten (AFM) (only notifications after July 1, 2013 are included):

|

Date |

Investor |

% of share capital |

|---|---|---|

|

26 September 2019 |

Invesco Limited |

3.06% |

|

20 August 2019 |

Janus Henderson Group plc |

5.02% |

|

27 Maart 2019 |

FIL Limited |

4.94% |

|

9 November 2015 |

Dimensional Fund |

3.18% |

|

18 November 2014 |

HAL Trust |

15.01% |

Investor Relations

The Company maintains open and active engagement with its shareholders and aims to provide information to the market which is consistent, accurate and timely. Information is provided among other means through press releases, presentations, conference calls, investor conferences, meetings with investors and research analysts and the Company website. The website provides a constantly updated source of information about our core activities and latest developments. Press releases and presentations and information on shareholder communication can be found there under the Investor Relations Center section.

Financial Calendar

|

|

|

|

|---|---|---|

|

Full-Year 2019 Earnings – Press Release |

13 February |

2020 |

|

Annual General Meeting of Shareholders |

8 April |

2020 |

|

Trading Update 1Q 2020 – Press Release |

14 May |

2020 |

|

Half-Year 2020 Earnings – Press Release |

6 August |

2020 |

|

Trading Update 3Q 2020 – Press Release |

12 November |

2020 |