1.6Position within the Value Chain

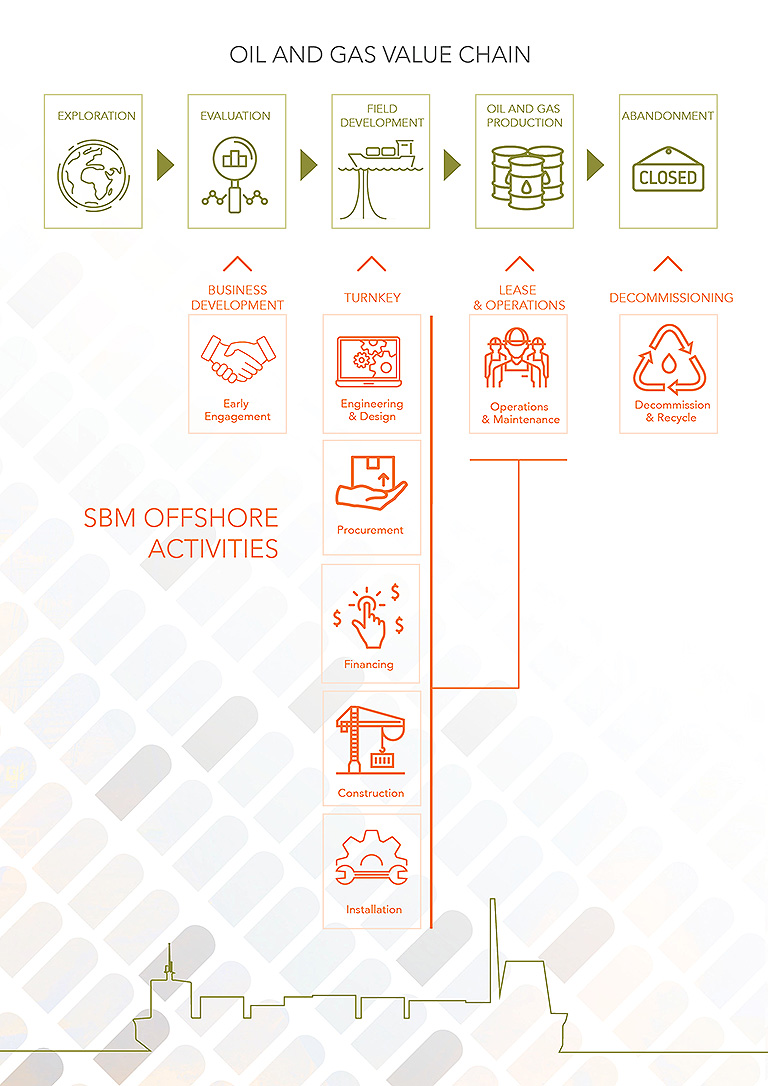

In line with its vision, SBM Offshore provides a broad range of products and services to its clients, aiming to unlock the potential energy associated with the oceans. The next illustration outlines the lifecycle phases of the oil and gas industry, at large, and SBM Offshore’s activities within this cycle. The Company has responded to the energy transition by focusing on the renewable energy market, as illustrated at the end of this section.

The Company’s clients typically control the complete value chain, from the initial offshore exploration phase to the physical distribution of hydrocarbon-based fuels. SBM Offshore adds value in this chain primarily with its field development activities. The Company is to a lesser extent involved in the transportation of hydrocarbons via its Terminals products, such as CALM Buoys. SBM Offshore is aware of the challenges inherent to the industry and the different needs of each stakeholder group and sometimes even within stakeholder groups. This is visible in the Value Creation Model in section 1.7 and addressed in the development of the Company's strategy, which is explained in section 2 Strategy and Performance.

SBM Offshore’s OIL AND GAS Value Chain

The Company adds value by leveraging its experience to succeed in winning business, executing projects on time and on budget and operating its fleet at maximum efficiency.

Engineering and Design

SBM Offshore has the capability to deliver conceptual studies, basic design and detailed design through in-house resources. SBM Offshore invests in product and technology development to maintain the required technology innovation and expertise to meet its clients’ requirements for specific field development and to increase its competitive advantage.

Procurement

SBM Offshore’s supply chain represents a substantial part of the total costs of constructing a Floating Production System. In line with its Fast4Ward® principles, the Company fosters an integrated supply chain, partnering with suppliers to develop efficient delivery of bulk equipment and services.

Financing

The Company ensures optimum results for clients by offering various financial models:

- Under a Lease and Operate contract, the facility is sold to asset specific companies – SBM Offshore usually retains a majority stake – to charter and operate the asset for the client throughout its lifecycle. The project debt financing is arranged at the asset specific companies level based on the facility’s value (which is based on construction costs and a margin). SBM Offshore Revolving Credit Facility is generally used to bridge the period until project debt financing is in place. The Company tends to optimize debt financing in the asset specific companies, in order to optimize return on equity. Upon acceptance of the production system by the client, generally upon production start, the Company’s corporate guarantee is relinquished and the project debt becomes non-recourse to the parent.

- Under a direct sale, the construction is financed by the client, and a margin is generated from the Turnkey sale.

- Under a hybrid of the two above, such as the build-operate-transfer model (BOT), SBM Offshore builds and commissions the unit, operating it during a defined period (the crucial start-up phase). The transfer of ownership to the client then occurs at the end of this defined period.

Construction

While maintaining responsibility for delivery and project management, SBM Offshore outsources most construction activities (for either conversion or new build Floating Production Systems) and has agreements in place with yards that allow delivery of Floating Production Systems through different execution models and local content requirements. SBM Offshore provides value through integration and project management.

Installation

Installation of the floating facilities is done with specialized installation vessels and requires specific engineering expertise and project management skills. SBM Offshore is the co-owner of two installation vessels that provide the capability to install its fleet of Floating Production Systems offshore, as well as to perform other offshore works for third-parties. Access to these vessels allows SBM Offshore to control the risks associated with cost fluctuations over the period of several years, from contract award to installation.

Operations & Maintenance

The asset specific companies, fully owned by SBM Offshore or co-owned with partners, which lease offshore facilities to clients, mostly operate such facilities as well. This activity creates value for clients, as the uptime performance of the facility directly impacts the amount of hydrocarbons produced. In most contracts, these asset specific companies are compensated for providing the production facilities by a fixed dayrate complemented by an operating fee. Income is independent of oil price fluctuations.

The FPSO facility processes the well fluids into stabilized crude oil for temporary storage on board, which is then transferred to a shuttle tanker to export it from the field. Oil and gas enhanced recovery systems are used to maintain production levels. To do this, secondary recovery systems for gas injection, water injection and gas lift systems are installed on the production facility. SBM Offshore’s latest FPSO designs can include CO2 removal from gas streams and reinjection into the well offshore. Operating and maintaining floating production facilities requires proven operational expertise and a robust management system: SBM Offshore has over 330 cumulative contract years of operational experience.

Decommissioning & Recycling

At the end of the lifecycle, the facilities are decommissioned and recycled. As the leased FPSOs are under SBM Offshore’s full or co-ownership, the Company applies the Hong Kong Convention rules to recycle its units, with the use of certified and regularly audited recycling yards. The processes surrounding the recycling of products at end-of-life are vital to sustainability and SBM Offshore works to ensure a practice of green recycling is met and that internationally-recognized regulations are followed. SBM Offshore has a 'Vessel Decommissioning and Recycling Process', which aims to detail the key steps in order to conduct green recycling of an offshore unit.

The Company uses recycling facilities which have adequately trained management and staff, with required health and safety procedures in place. The Company's process includes inspecting all vessels for hazardous materials, ensuring a controlled removal and disposal of such materials as part of the decommissioning and recycling of the vessel. SBM Offshore considers the environmental and social impacts related to the decommissioning and recycling activities of each vessel on an individual basis, with the objective to minimize adverse impact.

Recycling of Yetagun FSO

In mid-September, there was a broadcast on Dutch television on the recycling of Yetagun FSO unit at a shipbreaking yard in India. The broadcast criticized labor conditions in yards in the area and suggested that workers were insufficiently protected against health and safety risks. SBM Offshore did not agree with the picture as presented. Yetagun FSO was cleaned before recycling and SBM Offshore had taken additional measures to protect workers against specific contamination risks. The recycling of Yetagun FSO was performed in full accordance with widely recognized international standards.

SBM Offshore regularly reviews its projects in order to be able to apply lessons learned and to ensure the application of health, safety and environmental standards during the full lifecycle of the Company's products. SBM Offshore has liaised with key stakeholders on this specific subject during the year and will continue this engagement going forward.

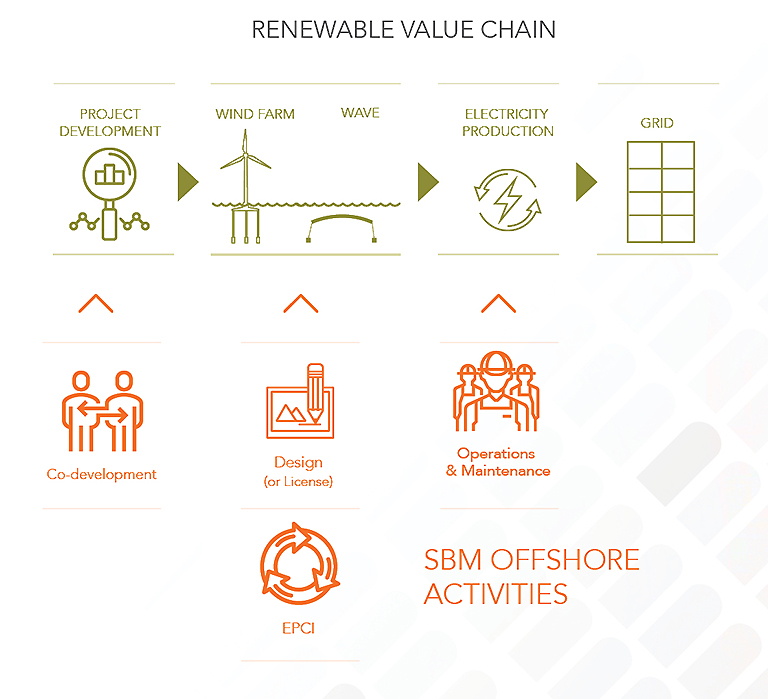

renewable energy Value Chain

Energy Transition

SBM Offshore’s strategy is to position the Company in this growing market sector as the energy mix evolves, with a more dominant role for renewables. SBM Offshore is investing in technology development for renewable energy, especially in floating offshore wind and wave energy. The process includes assessment of both Technology and Business Readiness Levels, which aim to certify the maturity of the product prior to the commercial phase. An important step in this process is the development of prototypes and pilots; this can also be done as co-development projects with partners and/or clients.