3.4.1Management Board Remuneration Policy

The current version of the remuneration policy (‘RP 2018‘) was adopted at the 2018 AGM and became effective January 1, 2018. Full details and the principles and rationale for the RP 2018 are available on SBM Offshore’s website in the Remuneration Policy section under Corporate Governance.

The Company remunerates members of the Management Board for long-term value creation. RP 2018 is based on competitive remuneration aligned with the long-term performance of SBM Offshore. It is built on six reward principles: simplicity, flexibility, predictability, competitiveness, alignment and, most importantly, driving the right results.

Shareholders’ Rights Directive and proposal for amendment to RP 2018

In December 2019, new legislation entered into force, implementing the EU Shareholders' Rights Directive (SRD II) in the Netherlands. During the AGM 2020, we will present to shareholders changes to RP 2018 to bring the policy into accordance with the new legislation. The details of these changes will be included in the agenda of the AGM 2020.

Also in accordance with the implementation of SRD II, this Remuneration Report contains additional disclosures with regard to Management Board remuneration at SBM Offshore.

Explanation of RP 2018

SBM Offshore believes the oceans will provide the world with safe, sustainable and affordable energy for generations to come. We share our experience to make it happen. The remuneration policy encourages a culture of long-term value creation and a focus on the long-term sustainability of the Company through the Value Creation Stake balanced with pay for performance through the Short-Term Incentive (STI). Sustainability is an integral part of the STI performance areas (through Health, Safety, Security and Environment). SBM Offshore’s values of Ownership and Entrepreneurship are embedded in the remuneration policy through alignment of interests of the Management Board with shareholders by means of the Value Creation Stake.

The Company’s strategy revolves around the pillars of Optimize, Transform and Innovate. These pillars are reflected in the STI performance areas of Profitability, Growth and HSSE (which includes Sustainability). Through the STI performance areas, Management Board remuneration is directly linked to the success of the Company and the value delivered to shareholders.

Employment conditions and pay of the Company's employees within SBM Offshore are being taken into account when formulating the remuneration policy, for instance regarding the STI performance areas and payment dates. Employment conditions for Management Board members may differ from those applicable to employee, also because Management Board members have a service contract rather than an employment relationship. The principles of the remuneration policy are used as a guideline for employment conditions at SBM Offshore as a whole.

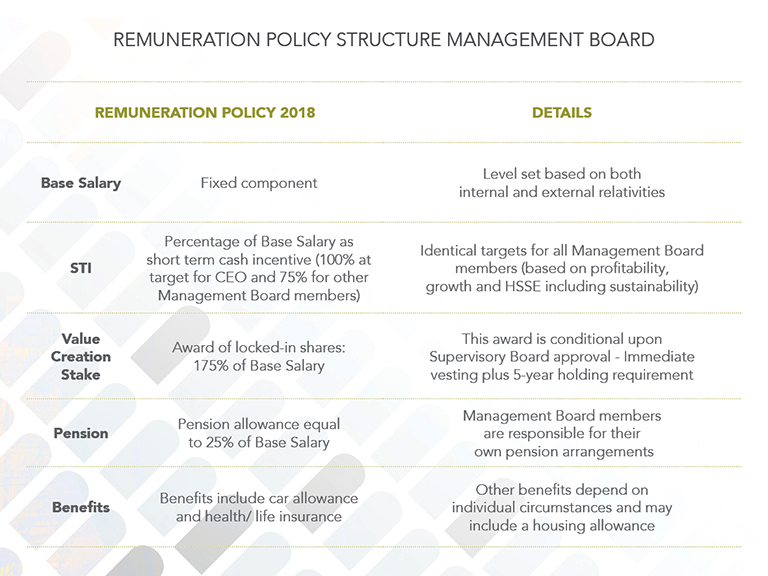

The four components of the remuneration package of Management Board members under RP 2018 are: (1) Base Salary, (2) STI, (3) Value Creation Stake and (4) Pension and Benefits.

1. Base salary

The Base Salary is set by the Supervisory Board and is a fixed component paid in cash. Depending on internal and external developments such as market movements, the Supervisory Board may adjust Base Salary levels.

2. Short-Term Incentive

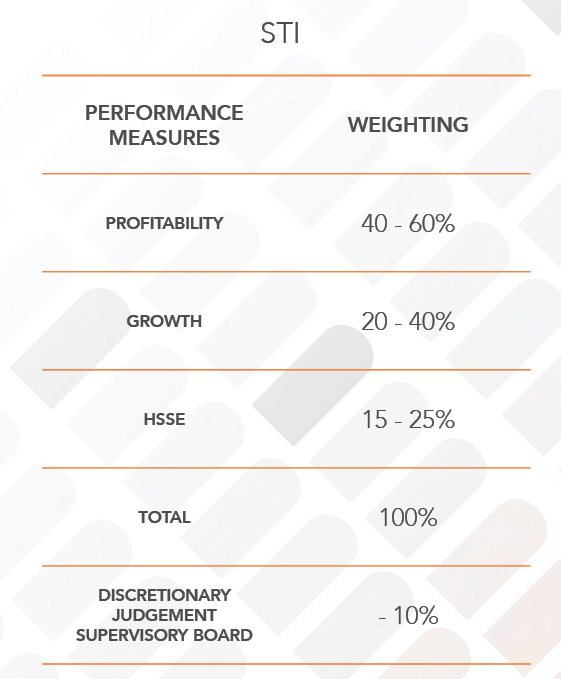

The STI is designed to create a rigorous pay for performance relationship and is a conditional variable component. The STI key performance indicators focus on three performance areas: (i) Profitability, (ii) Growth and (iii) HSSE 1. The Supervisory Board, upon the recommendation of the A&RC determines for each of the performance measures the specific performance targets and their relative weighting in the beginning of the financial year.

The three performance areas are specified as follows:

- Underlying and directional EBITDA is used as an indicator of overall short-term profitability. This indicator is used and understood across SBM Offshore and the primary operational driver of performance.

- Order Intake and/or the number of FEEDs is used as an operational indicator of top line growth. Its relative weight for the STI payout is lower, as growth should never be at the detriment of profitability.

- HSSE performance combines key performance areas to ensure discipline in how SBM Offshore operates. These areas are composed by a combination of leading and lagging indicators, to be selected by the Supervisory Board each year depending on measurability and priorities.

If the Supervisory Board is of the opinion that another measure would be more qualified as an indicator for profitability, growth or HSSE, it will inform the shareholders in the remuneration report. Performance measures will never be adjusted retrospectively.

Performance ranges – threshold, targeted and maximum - are set for each of the key performance indicators. The STI is set at a target level of 100% of the base salary for the CEO and 75% of the base salary for any other member of the Management Board. The threshold pay-out is at 0.5 times target and maximum pay-out will not exceed 1.5 times target. A linear pay-out line applies between threshold and maximum. Below threshold, the pay-out is zero.

The Supervisory Board appreciates that transparency and accountability require a precise STI measurement. Therefore, the Supervisory Board will no longer apply discretion to increase the outcome of the STI. The Supervisory Board may still adjust the outcome of the STI down by up to 10%, which adjustment will be reported on in the remuneration report.

At the end of the performance year, the performance is reviewed by the Supervisory Board and the pay-out level is determined. The performance measures, target setting, and realization are published in this remuneration report. For reasons of commercial and/or market sensitivity, these details are not published at the start of the performance period. In general, details regarding order intake will not be shared. The STI is payable in cash after the publication of the Annual Report for the performance year.

3. Value Creation Stake

The Value Creation Stake is an award of restricted shares to create direct alignment with long-term shareholder value. The awarded shares must be held for at least five years. After retirement or termination, the shares cannot be sold for the duration of two years. The gross annual grant value for each of the Management Board members is 1.75 times base salary. The number of shares is determined by a four-year average share price (volume-weighted). The Value Creation Stake has a variable element to the extent that the share price develops during the holding period. The Supervisory Board retains the discretion not to award the Value Creation Stake in exceptional market or business circumstances (‘underpin‘).

The Supervisory Board determined to award restricted shares through the Value Creation Stake due to the difficulty in establishing meaningful relative long-term measures in the market SBM Offshore is active in. This difficulty arises from the nature of our primary business where the period leading to a contract / construction is approximately two to four years with Lease and Operate contracts typically lasting twenty years. Such long-term contracting processes and contracts often disconnect the Company’s performance from other offshore services companies whose performance is more short-term. Additionally, the Company’s two primary business lines – Lease and Operate and Turnkey – tend to be offset in terms of revenue generation, making it complicated to compare our performance to others in the industry.

The below graph illustrates disconnect of the share price performance of SBM Offshore compared to the Offshore Services Industry (OSX) over the past five years.

OSX versus SBM Offshore 2015-2019

For these reasons, establishing a set of realistic, robust and stretching long-term financial targets via a Long-Term Incentive (LTI) plan has proven to be very challenging. Since there is a strong connection between pay in the form of shares and performance in the form of shareholder value, the Value Creation Stake creates full alignment with shareholders, and rewards long-term Company performance. The Supervisory Board considers the Value Creation Stake as the most appropriate way to align the remuneration for management with the interests of shareholders.

All members of the Management Board are required to build up Company stock of at least 3.5 times their gross base salary. The value of the share ownership is determined at the date of grant.

4. Pension and Benefits

The Management Board members are responsible for their own pension arrangements and receive a pension allowance equal to 25% of their base salary for this purpose.

The Management Board members are entitled to additional benefits, such as a company car allowance, medical and life insurance and (dependent on the personal situation of the Management Board member) a housing allowance.

key elements employment agreements

Each of the Management Board members has entered into a four-year service contract with the Company, the terms of which have been disclosed in the explanatory notice of the General Meeting of Shareholders at which the Management Board member was (re-)appointed.

Adjustment of remuneration and claw-back

The service contracts with the Management Board members contain an adjustment clause giving discretionary authority to the Supervisory Board to adjust upwards or downwards the payment of the STI and LTI (as granted under RP 2015), if a lack of adjustment would produce an unfair or unintended result as a consequence of extraordinary circumstances during the period in which the performance criteria have been, or should have been achieved. However, the Supervisory Board has determined that upward adjustments will not be considered as part of RP 2018 based on shareholder feedback.

A claw-back provision is included in the services contracts enabling the Company to recover the Value Creation Stake, STI and/or LTI (as granted under RP 2015) on account of incorrect financial data.

Severance Arrangements

The Supervisory Board will determine the appropriate severance payment for Management Board members in accordance with the relevant service contracts and Dutch Corporate Governance Code. The current Dutch Corporate Governance Code provides that the severance payment will not exceed a sum equivalent to one times annual base salary. This also applies in a situation of a change in control.

Loans

SBM Offshore does not grant loans, advance payments or guarantees to its Management Board members.