3.4.2Execution of the Management Board Remuneration Policy in 2019

The Supervisory Board is responsible for ensuring that the Remuneration Policy is appropriately applied and aligned with the Company’s objectives. The remuneration level is determined by the Supervisory Board using a comparison with Dutch and international peer companies, as well as internal pay ratios across the Company.

Reference Group

In order to determine a competitive base salary level and to monitor total remuneration levels of the Management Board, a reference group of relevant companies in the industry (the ‘Reference Group‘) has been defined. Pay levels of the Management Board members are benchmarked annually to the Reference Group. In the event a position cannot be benchmarked within the Reference Group, the Supervisory Board may benchmark a position to similar companies. In 2019, the Reference Group consisted of:1

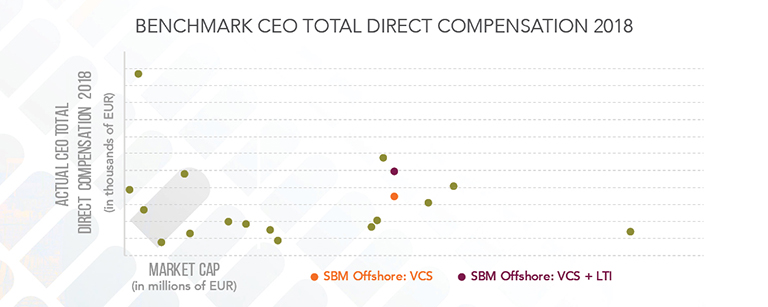

Also in 2019, the Supervisory Board assessed the Management Board's remuneration in relation to the Reference Group's pay levels, revenue and market capitalization. An example of the Supervisory Board’s analysis as performed by an independent consultant are shown in the graph below. The graph compares the same variables at actual pay levels for the year 2018. This is one year only and actual remuneration can – and should – vary from year-to-year.

The final determination of pay levels for the Management Board also took into account various scenario analyses to assess the impact of different performance levels and share price developments on the total remuneration paid.

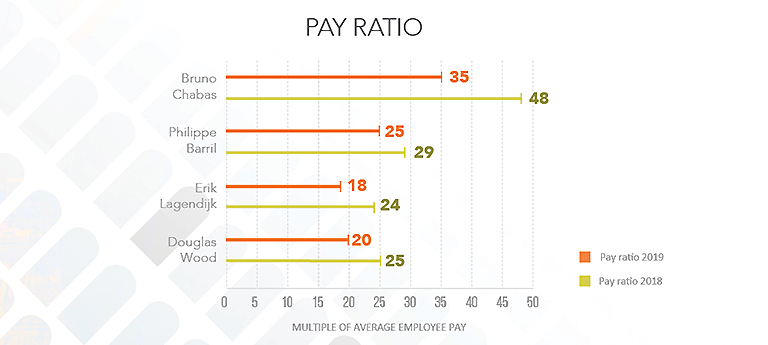

Pay ratios

The Supervisory Board also includes internal pay ratios when assessing Management Board pay levels.2 In 2019, the average total employee expenses was EUR117 thousand. The pay-ratio’s of each of the Management Board members over 2019 and 2018 are displayed in the following graph.

Total Remuneration overview

The table below provides you with insight in the costs for SBM Offshore for Management Board reward in 2019. The table below presents an overview of the remuneration of the Management Board members who were in office in 2019. The proportional costs of the former Long-Term Incentive (LTI) 2017-2019 program (under RP 2015) are included in this table. It is important to note that the former LTI program has a delay in vesting. This means that Management Board members do not receive any shares in the first three years after award. With the adoption of RP 2018, the LTI was replaced by the Value Creation Stake which vests upon award. As a result, both the former LTI and the Value Creation Stake are reporting in this table.

|

Bruno Chabas |

Philippe Barril |

Erik Lagendijk |

Douglas Wood |

Total |

||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

in thousands of EUR1 |

2019 |

2018 |

2019 |

2018 |

2019 |

2018 |

2019 |

2018 |

2019 |

2018 |

|

Base salary |

800 |

800 |

634 |

551 |

450 |

450 |

484 |

450 |

2,368 |

2,251 |

|

STI |

916 |

1,165 |

544 |

601 |

386 |

491 |

415 |

491 |

2,261 |

2,748 |

|

Value Creation Stake |

1,372 |

1,508 |

1,134 |

1,038 |

772 |

848 |

845 |

848 |

4,122 |

4,244 |

|

Pensions |

245 |

245 |

158 |

138 |

113 |

113 |

121 |

113 |

637 |

608 |

|

Other |

165 |

165 |

147 |

146 |

39 |

38 |

41 |

39 |

392 |

389 |

|

Total Remuneration |

3,498 |

3,883 |

2,617 |

2,475 |

1,760 |

1,940 |

1,906 |

1,941 |

9,780 |

10,239 |

|

LTI (RP 2015)2 |

630 |

1,470 |

325 |

740 |

325 |

712 |

419 |

836 |

1,699 |

3,758 |

|

Total Remuneration including LTI |

4,128 |

5,353 |

2,942 |

3,215 |

2,085 |

2,652 |

2,325 |

2,778 |

11,479 |

13,997 |

|

in thousands of US$ |

4,621 |

6,321 |

3,293 |

3,796 |

2,334 |

3,132 |

2,603 |

3,281 |

12,851 |

16,530 |

- 1 Peter van Rossum retired as Management Board member during the extraordinary meeting of shareholders of November 30, 2016 and his contract ended at the Annual General Meeting of April 13, 2017. There is a minor adjustment to prior year LTI expenses related to Peter van Rossum in 2019.

- 2 LTI (RP 2015) expenses are inclusive of expenses related to sign-on RSUs.

1. Base Salary

As part of the re-appointment of Philippe Barril during the 2019 Annual General Meeting, it was resolved to increase his Base Salary from EUR551 thousand to EUR664 thousand effective from January 1, 2019. In August 2019, the A&RC performed a benchmark analysis for the reward level of the CFO. For this, the A&RC engaged an external reward firm, who produced a detailed report. The Supervisory Board resolved to increase Douglas Wood's Base Salary to EUR518 thousand effective from July 1, 2019. The 2019 and 2018 Base Salary levels are shown both in the table at the beginning of section: Management Board Remuneration in 2019 and in the table Remuneration of the Management Board by member in section 3.4.3.

2. Short-Term Incentive

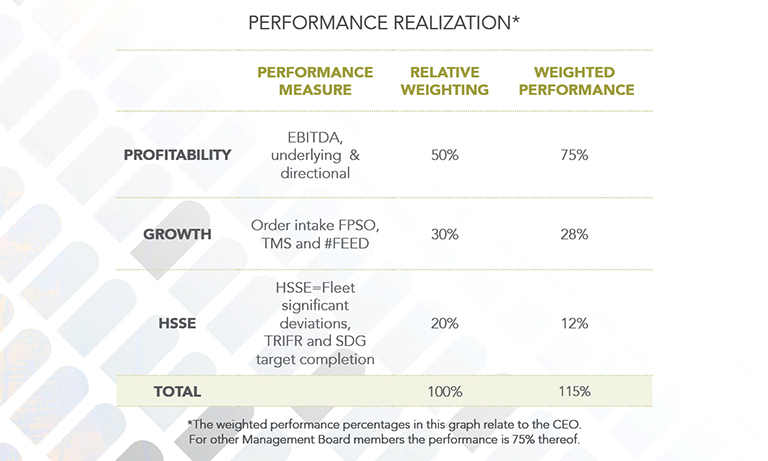

For 2019, the Supervisory Board set the following performance measures and corresponding weighting, which led to the following performance realization. For full details regarding the performance under the STI, please refer to the Performance STI 2019 table in section 3.4.3.

Underlying directional EBITDA resulted in US$832 million against target level of US$750 million. Order intake related to new projects (FPSO, Turret Mooring Systems and FEEDs). Two FPSO contracts were secured. For reasons of commercial sensitivity, no details about the further order intake achievements are disclosed. Regarding the HSSE targets and Process Safety, a leading indicator measured by Fleet Significant Deviations (50% Reduction vs. 2018 YE baseline), scored above maximum. As a result of the fatal injury in 2019, TRIFR contributes for 0%. A TRIFR score of 0.13 was achieved. Since flaring reduction and plastic waste reduction scored below the ambition level, the SDGs also did not contribute to the STI.

3. Value Creation Stake

The Supervisory Board decided to grant the Value Creation Stake for 2019 to the Management Board members in accordance with RP 2018. The 2019 Value Creation Stake award for Philippe Barril and Douglas Wood respectively were adjusted due to their Base Salary increase per January 1, 2019 and July 1, 2019 respectively. As per RP 2018, the granted Value Creation Stake vests immediately. The gross annual value for each of the Management Board members is 175% of base salary. The number of shares was based on the four year average share price (volume weighted) at the date of the respective grant. The cost of the granted Value Creation Stake is included in the table at the beginning of this section 3.4.2. The number of shares vested under the Value Creation Stake can be found in section 3.4.3 of this Remuneration Report under Conditions of and information regarding share plans.

The actual shareholdings of the Management Board members per the end of 2019, in which only conditional shares are taken into account, can be found at the end of the Overview Share-Based Incentives (section 3.4.3). This overview also includes the number of conditionally granted and/or vested shares in the last few years.

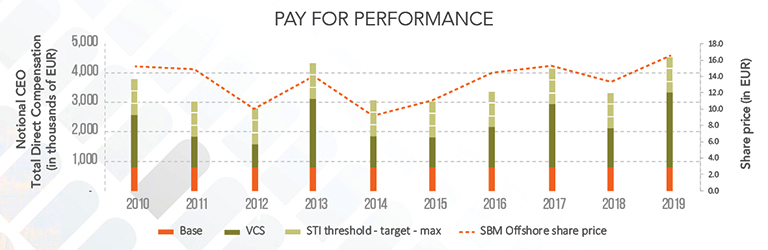

Pay for Performance

In 2019, the Supervisory Board performed an analysis through an independent third-party consultant to evaluate the relationship between the Company’s performance and the Management Board’s remuneration package. The Supervisory Board chose a methodology that is based on mandatory UK disclosure requirements. To test the long-term relationship, the assumption was taken that RP 2018 had been effective since 2009. For each year, the components include: (i) Base salary as applied in 2019, (ii) STI percentages as applied in 2019 – minimum and maximum policy level, (iii) Value Creation Stake percentages as applied in 2019 – as this is an equity instrument, the value includes share price development over the previous five years (total lock-in period).

Since approximately half the remuneration package of Management Board members consists of share-based remuneration, the analysis shows a high degree of alignment with the share price.

From this analysis, the Supervisory Board concluded that remuneration practices under RP 2018 provides strong long-term alignment between the Management Board and shareholders.

4. Long-Term Incentive UNDER REMUNERATION POLICY 2015 (RP 2015)

RP 2015 was applicable from 2015 until 2018 and included a LTI scheme. Further details on the LTI are available in the 2014 Annual General Meeting section on SBM Offshore’s website and in the Remuneration Report 2017. The last LTI program (LTI 2017-2019) was granted in 2017 and ended in 2019.

LTI 2017-2019

The 2017-2019 LTI program that was granted in 2017 contained two Performance Indicators: Directional Underlying Earnings Per Share (relative weighting 60%) and Relative Total Shareholder Return (TSR) (relative weighting 40%).

The Supervisory Board, upon the recommendation of the A&RC, assessed the delivered results and concluded that the results for both the Underlying Earnings Per Share and the Relative TSR were realized at maximum. The costs for the Company regarding the LTI 2017- 2019 in 2019 can be found in the table at the beginning of this section 3.4.2.

The 2016 – 2018 LTI program under RP 2015 concluded on December 31, 2018. The value earned related to 2016-2018 only. However, the last portion of the LTI program 2016-2018 under RP 2015 vested in 2019. No additional LTI performance cycles or shares were initiated.

Shareholding requirement Management Board

The following table contains an overview of shares held in SBM Offshore N.V. by members of the Management Board per December 31, 2019.

|

Shares subject to conditional holding requirement |

Other shares |

Total shares at 31 December 2019 |

Total shares at 31 December 2018 |

|

|---|---|---|---|---|

|

Bruno Chabas |

368,448 |

607,462 |

975,910 |

793,588 |

|

Philippe Barril |

278,428 |

- |

278,428 |

165,047 |

|

Erik Lagendijk |

143,984 |

- |

143,984 |

69,351 |

|

Douglas Wood |

115,614 |

- |

115,614 |

33,924 |

|

906,474 |

607,462 |

1,513,936 |

1,061,910 |

Except for Douglas Wood, all Management Board members met the share ownership requirement, which is set at an equivalent of 350% of base salary.

Section 3.4.3 contains more information about the (historical) share plans for the Management Board.

5. Pensions and benefits

Management Board members received a pension allowance equal to 25% of their base salary. In case these payments are not made to a qualifying pension fund, Management Board members are individually responsible for the contribution received and SBM Offshore withholds wage tax on these amounts. A pension arrangement (defined contribution) is in place for the CEO and its costs are included in the table at the beginning of this section 3.4.2.

The Management Board members received several allowances in 2019, including a car allowance and a housing allowance (Bruno Chabas and Philippe Barril). The value of these elements is included in the table at the beginning of this section 3.4.2 and in section 3.4.3.